? 1. Agency theory (Why)

![]()

1.1 Agency theory

Illustration

Illustration

Fiduciary duty

Fiduciary duty is a duty of care and trust which one person or entity owes to another. It can be a legal or ethical obligation.

The duty is more onerous than generally arises under a contractual or tort relationship. It requires full disclosure of information held by the fiduciary, a strict duty to account for any profits received as a result of the relationship, and a duty to avoid conflicts of interest.

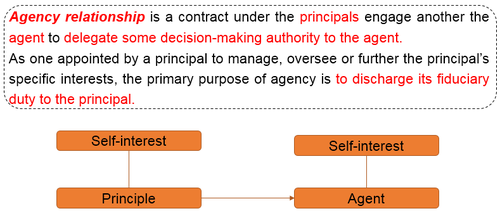

1.1 Agency theory

Agency theory is used to study the problems of motivation and control when a principal needs the help of an agent to carry out activities.

1.1.1 The agency problem

In corporate finance, the agency problem usually refers to a conflict of interest between a company's management and the company's shareholders. The manager, acting as the agent for the shareholders, or principals, is supposed to make decisions that will maximize shareholder wealth even though it is in the manager’s best interest to maximize his own wealth.

It also derives from the principals (shareholders) not being able to run the business themselves and therefore having to rely on agents (directors) to do so for them, despite the fact that they cannot always trust their agents to do everything they would want them to.

1.1.2 Agency monitoring system (How to reduce the Agency Problem)

Principals can take a number of steps to monitor their agents when they perceive the agency problem to be present (or at risk of materializing) .

? Remuneration and incentive contracts

? Request formation of committees (Subcommittees)

? Employ consultants

? Increase numbers of NEDs (4 roles)

? Attend AGM and question the board

? One-to-one meetings management

1.1.3 Agency cost

Any steps taken by shareholders are likely to incur 'agency costs'. Common agency costs include:

? Costs of studying company data and results (either in-house or externally)

? Purchase of expert analysis (such as consultants)

? External auditors' fees

? Costs of devising and enforcing directors' contracts (see later content on remuneration)

? Time spent attending company meetings (such as the annual general meeting or AGM)

? Costs of direct intervention in the company's affairs (including legal fees)

? Transaction costs of shareholding (such as brokers' fees and any tax implications for dividends)